Imagine making money while you’re sleeping or walking the dog at least that’s the dream pitched by countless trading bot providers. All you have to do is just fire up an automated program powered by advanced algorithms to trade stocks, crypto, and more on full autopilot. But what’s the catch?

Because if you’re thinking that it’s too good to be true, you’re far from alone; thousands of other traders are asking the same question.

If you’re reading this, you’re weighing an AI trading bot for yourself. This breakdown cuts through the hype, explaining how they work, whether they deliver in real-world markets, and what all the fuss is truly about. But first, let’s start with the basics.

What Are AI Trading Bots: Key Perks

A basic AI definition is computer systems that mimic human intelligence tasks, such as learning from data, spotting patterns, and making choices. AI bots rely on this superpower, applying it to markets. Here’s a quick breakdown of what they obsessively monitor and analyze:

- Price Movement: Bots are busy tracking live quotes, trading volume, and gauging volatility. They detect when prices start to explode or make a sudden U-turn across a range of assets, such as Bitcoin or Forex pairs like EUR/USD.

- Sentiment Analysis: They dig into the news, analyze X meltdowns, and monitor Reddit threads, using natural language processing to figure out whether market sentiment is bullish or quietly panicking.

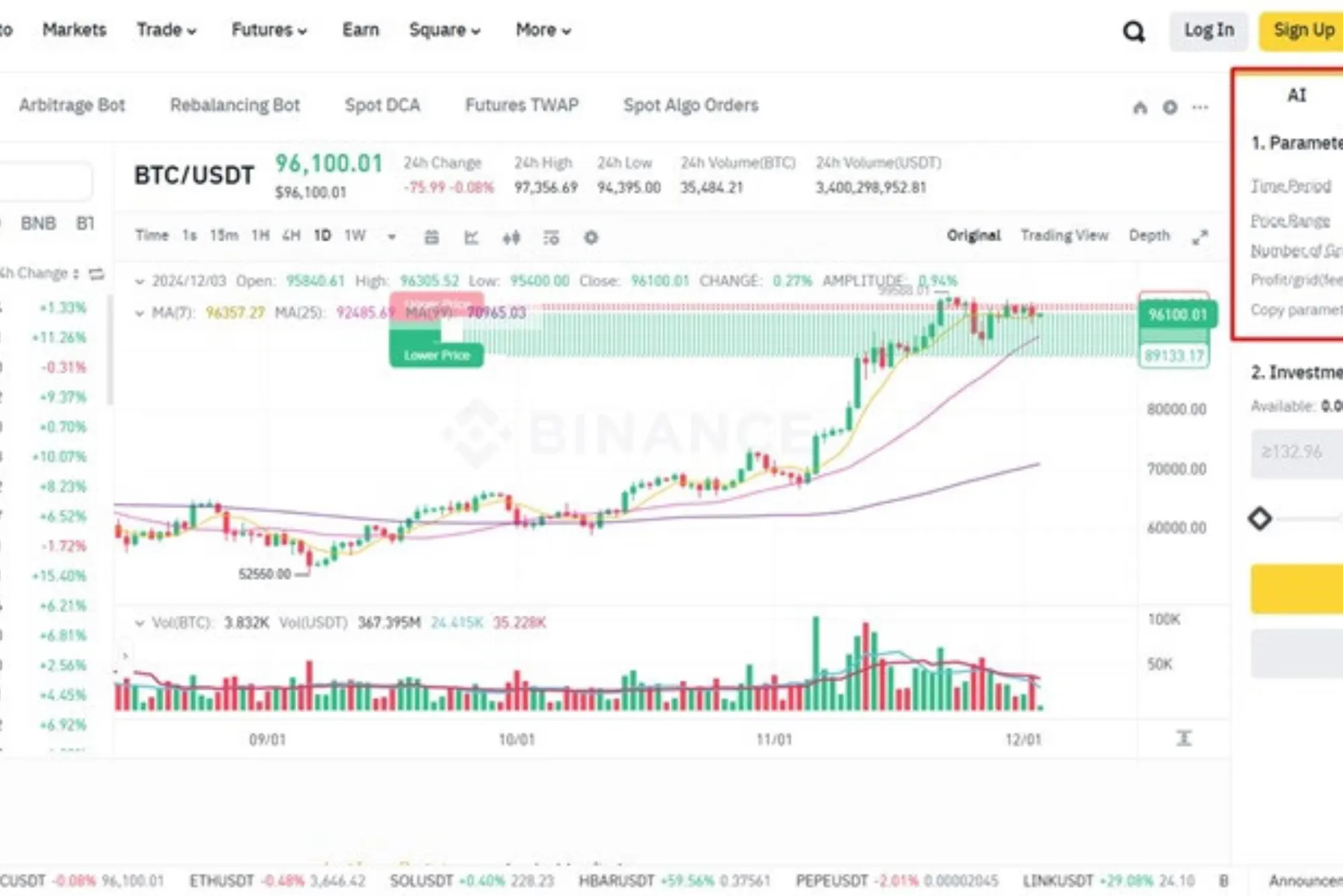

- Arbitrage Opportunities: Spotting small differences between exchanges (for instance, a bot would buy BTC cheaper on Binance and sell it higher on Coinbase) is another area where bots excel.

- Backtesting: With so much historical data available, you can backtest strategies against past performance to see how your bot performs. Based on the results, you can tailor and fine-tune the performance.

Your involvement in all of this is often minimal, though you still need to adjust the algorithm, as in a constantly evolving market, it can get outdated pretty quickly.

Do They Really Work: Key Concerns

Critics often argue that trading bots are pointless for one specific reason: retail algorithms just can’t compete with military-grade, advanced systems used by hedge funds and billion-dollar quant shops. How can a freelance trader ever compete with all that? It’s a valid criticism, because the gap between retail and industry-level bots is massive:

- Speed and Infrastructure: Institutional high-frequency trading reacts in microseconds as industry-level bots rely on servers located next to the exchange data centers. Retail bots react in milliseconds at best, deal with slippage, and exchange fees.

- Massive Data & Resource Gap: Top institutions use alternative data that retail bots couldn’t even dream about: geolocation patterns, shipping container flows, real-time credit card spending trends, and much more. Retail tools, on the other hand, stick to public price, volume, and basic sentiment analysis, like X meltdowns or breaking news.

- Overfitting and Adaptability: A major issue for retail bots: they are heavily optimized for historical data (and perform splendidly there!). Live markets are a different beast altogether: from new regulations and geopolitical shocks to regime changes, retail bots often stumble when dealing with ever

- changing markets: Institutional setups, however, are constantly retrained on a massive compute cluster with teams of PhDs monitoring, fine-tuning, and perfecting their performance.

Feel yet that retail bots are a complete waste of time? Don’t. The reality is the playing field isn’t level, but the truth is that it probably will never be. Although you can’t compete with industry-level setups, retail bots are far from pointless.

When to Use Retail Bots?

Think about this way: you’re not competing with an HFT setup trained on exotic datasets. You’re playing on a much smaller scale, where steady and accessible automation trumps sheer speed. Here’s our top advice on when (and why) using a retail bot is actually an excellent idea:

- Niche and Smaller Markets: Established institutions often ignore (or can’t deploy big capital in) less liquid assets that they can’t buy or sell quickly without affecting their price. They often avoid micro-cap stocks, altcoins, and exotic Forex pairs, because the niche is too small for a top-dog.

- No Human Factor: Even simpler retail bots allow unlocking the emotion-free consistency in your trading routine. Don’t dismiss its efficacy: many users report higher win rates in favorable conditions by eliminating the unhealthy vortex of anxiety and revenge trading.

- Hybrid Approach: Human factor has its faults (we’ve just pinpointed some of them above), but it’s also what can boost your algo trading. Here’s a sweet spot that many traders have discovered: they use bots for speed, 24/7 monitoring, and some grunt work. The rest? Rely on your judgment for oversight, strategy, and risk tweaks.

Ultimately, retail AI trading bots are a must, even if you’re operating on a pretty small scale. With the amount of 24/7 market data traders have to process, dealing with it manually results in losing the edge.

Starting Up: Main Tips

If you’re only beginning trading on Forex or crypto markets, start by choosing a reputable platform that offers a free trial, refund, real trading data results, and positive reviews from other traders — consider all these your must-have green flags. Next, define some basic rules, like entry–exit thresholds and maximum risk you’re willing to take per trade. Many traders set them at 1-2% of all capital.

With this nifty setup, you still have to monitor your performance at least weekly. While you’re at it, remember the golden rules of trading: always diversify across your assets and never invest more than you can lose.

Conclusion

Retail bots can’t compete with the hedge fund setup, but this doesn’t mean they won’t give you an edge. Think about them as your automation assistants that process huge swathes of data that no human trader can. Under the right conditions and with a clever approach, you can get steady gains in everything from arbitrage to grid trading. Just remember that just setting the bot up and forgetting about it won’t work; you must be actively involved in the process, continuously deepen your knowledge, and treat bots as little data-churning helpers, not your replacement.